They say only two things in life are certain: death and taxes. And of course, most of us would like to ensure that when we die, most of our assets go to loved ones, not to taxes.

That’s why naming a beneficiary to your account is critical. If you were to pass away without naming a beneficiary, all of your assets would become part of your estate and would be subject to applicable estate taxes.

In this article, we’ll explain how you can designate beneficiaries on your eligible registered Assante Connect accounts.

What accounts are eligible for beneficiary designations?

The following accounts are eligible:

- RRSP, Spousal RRSP

- TFSA

- RRIF, Spousal RRIF

- LIRA

- LIF

Other account types should be considered through your estate planning and will.

Definitions: Who can be named as a beneficiary or successor?

What is a Successor?

You can name your spouse or common-law partner as your successor. When you pass, a successor can take control of the account directly as the annuitant, allowing the money to remain within the registered plan. This status applies only to RRIF and TFSA accounts.

What is a Beneficiary?

A beneficiary can be anyone you choose to name (including your own estate) and receives the proceeds of the account upon your passing. Money is paid out of the registered plan. In the case of retirement accounts, withholding taxes may apply.

What is a Contingent Beneficiary?

In the case where a beneficiary or successor is not living at the time of your passing, the proceeds will be divided equally with the Contingent Beneficiaries listed. If you wish to elect a specific percentage, please fill out a Beneficiary and Contingent Beneficiary Designation form and mail the completed form to Assante Connect.

Suite 900 - 625 Howe Street

Vancouver, BC V6C 2T6

Frequently Asked Questions

Where can I see the successor, beneficiaries and contingent beneficiaries for my account?

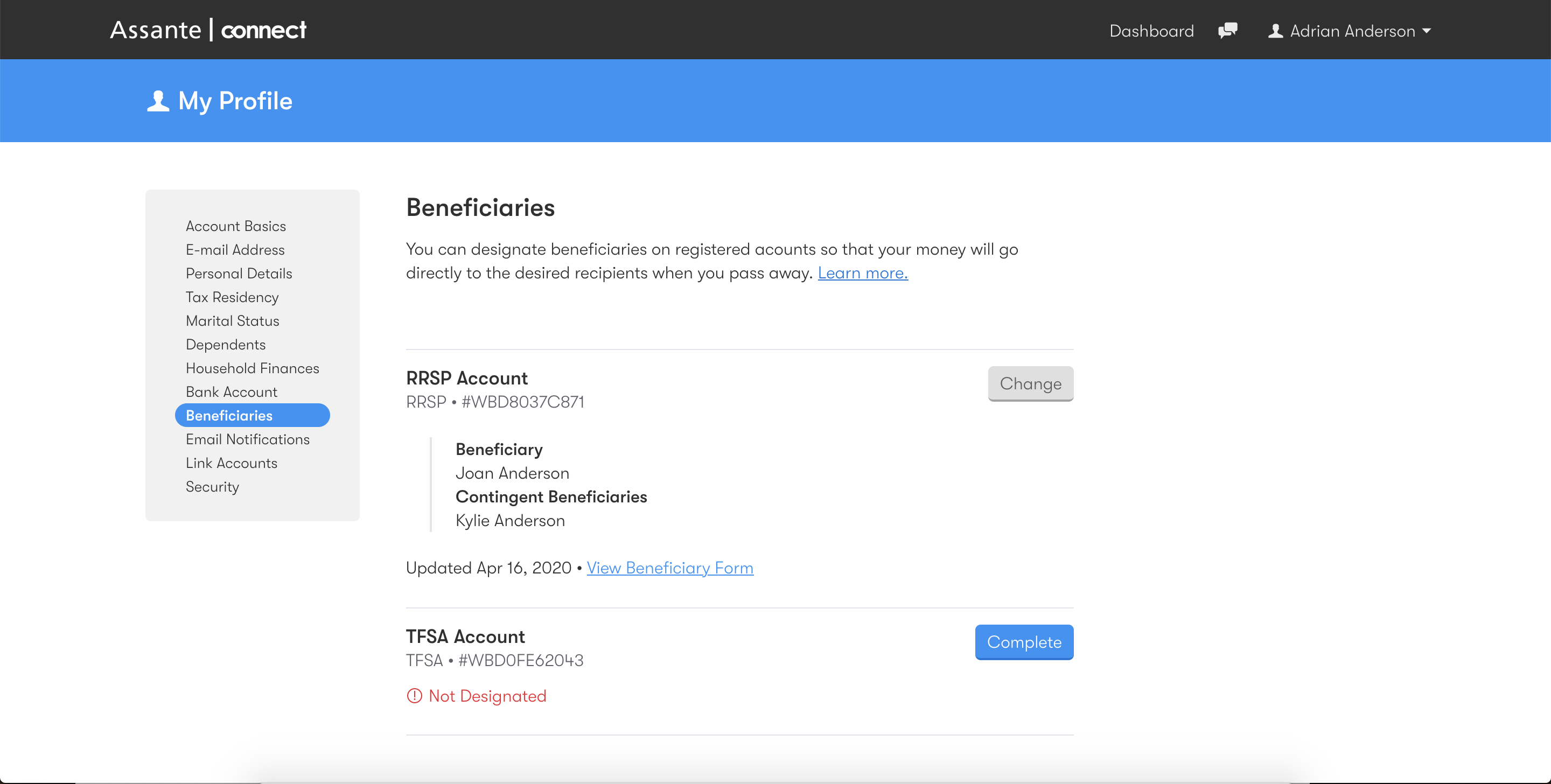

Log in to Assante Connect through a web browser (on desktop or mobile), and click on your name at the top right corner. Under Profile, click Beneficiaries.

Do you need the SIN of my successors and designated beneficiaries?

This is not required but is recommended as it does help with identifying the beneficiary after you have passed.

Do I need to include this in my will?

Beneficiary forms will supersede your Last Will and Testament. However, you should ensure that your will has the same instructions to avoid that aspect of your estate goals being contested.

Does the beneficiary form need to be notarized?

No.

Do I need a witness for this document?

No.

I live in Quebec, can I complete this form?

If you live in Quebec, you are not eligible to complete the Beneficiary form. Consult provincial rules for estates.

Where can I get a copy of the form once I’ve completed it?

You will be able to view a copy of your Beneficiary form in the Documents section under the tab Other. The form will be called Beneficiary Designation.

Where can I see the successor, beneficiaries and contingent beneficiaries for my account?

If you had submitted your Beneficiary Form before the online Beneficiary form option was available, you should be able to view the Beneficiary Designation on your monthly statement. If you cannot see the name of your beneficiary or cannot locate it, contact us.

I live in another country, what happens to my assets?

That depends on a number of factors, such as your tax residency and estate laws in the country where you pass away. We recommend that you still have a Canadian Last Will and Testament. We also recommend speaking with an Estate Planner in your country of residence.

How do I name a beneficiary or successor to my Assante Connect account?

- First, log in to your Assante Connect account through a web browser (on desktop or mobile), and click on your name at the top right corner. Under Profile, click Beneficiaries.

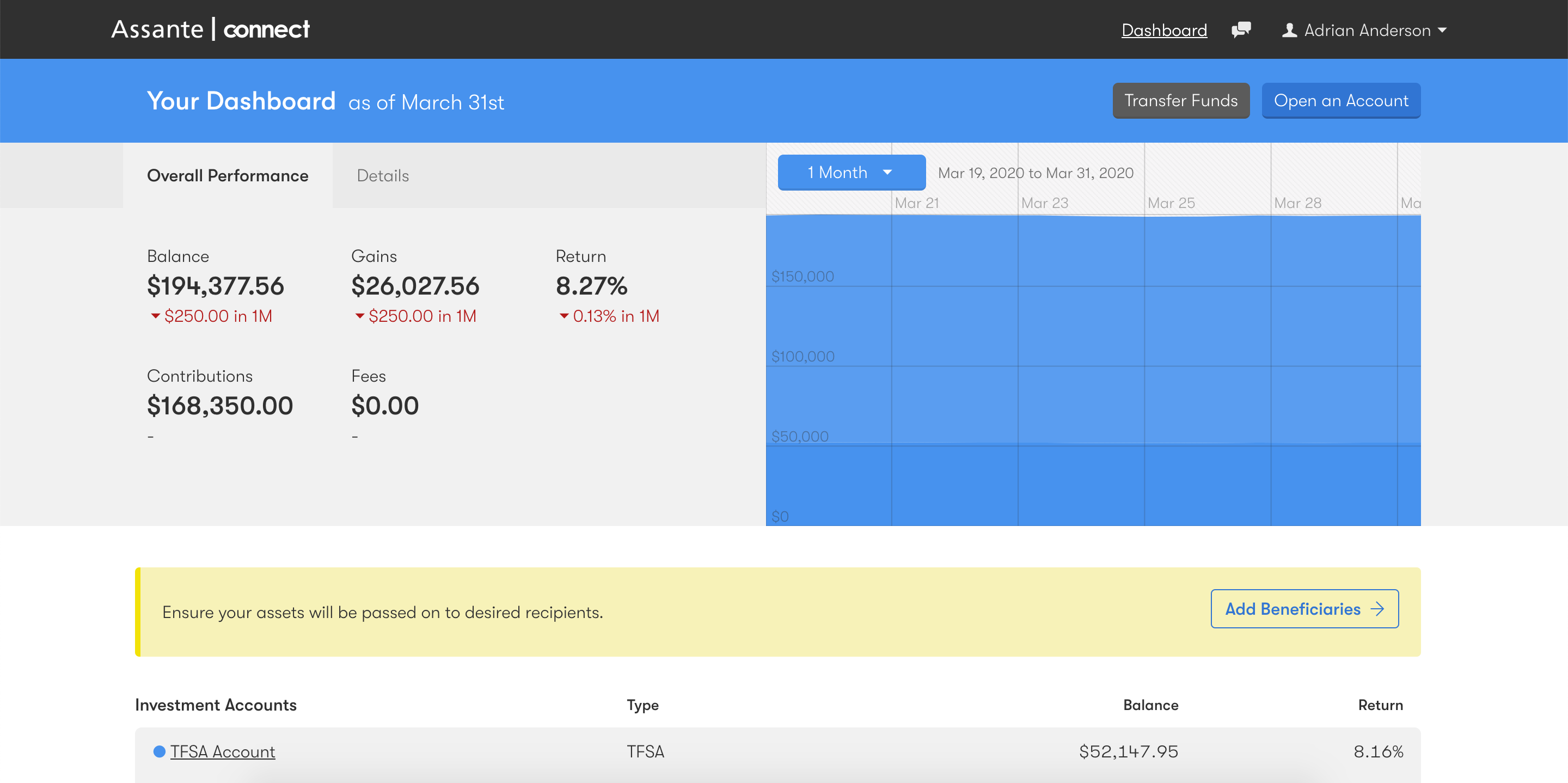

If you’ve just opened a new account, you’ll see a yellow banner notification on your dashboard that will take you here directly.

- Click Complete to initiate or Change to update a Beneficiary Designation Form.

- In the pop-up window, confirm that the information displayed including your home address, phone and full name is correct. If you need to update the information, you can do so by clicking on Make Changes. You can also update your personal information in the Personal Details section of your Profile.

- Fill out the details for your beneficiary(s). You’ll need to know their address, if different from your own.

- The final window will display an Adobe Sign document. Confirm that the details reflect the information that you’ve provided before providing your e-signature.

- If you have multiple accounts, you’ll need to repeat the process for each account.

If you’re unsure whether you’ve already filled out a form, you can contact us, or simply initiate a new form by following the steps above. We’ll always refer to the most recent form on file.